Multiple Choice

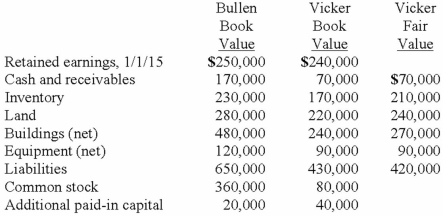

Bullen Inc. acquired 100% of the voting common stock of Vicker Inc. on January 1, 2013. The book value and fair value of Vicker's accounts on that date (prior to creating the combination) follow, along with the book value of Bullen's accounts:  Assume that Bullen issued 12,000 shares of common stock with a $5 par value and a $42 fair value for all of the outstanding shares of Vicker. What will be the consolidated Additional Paid-In Capital and Retained Earnings (January 1, 2013 balances) as a result of this acquisition transaction?

Assume that Bullen issued 12,000 shares of common stock with a $5 par value and a $42 fair value for all of the outstanding shares of Vicker. What will be the consolidated Additional Paid-In Capital and Retained Earnings (January 1, 2013 balances) as a result of this acquisition transaction?

A) $60,000 and $490,000.

B) $60,000 and $250,000.

C) $380,000 and $250,000.

D) $464,000 and $250,000.

E) $464,000 and $420,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q37: What term is used to refer to

Q79: Goodwill is often acquired as part of

Q92: In an acquisition where control is achieved,

Q93: On January 1, 2013, the Moody Company

Q94: Direct combination costs and stock issuance costs

Q95: The financial balances for the Atwood Company

Q98: Carnes has the following account balances as

Q100: Carnes has the following account balances as

Q101: On January 1, 2013, the Moody Company

Q102: Lisa Co. paid cash for all of