Multiple Choice

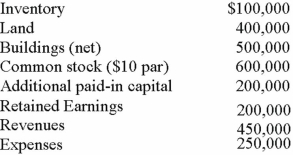

Carnes has the following account balances as of May 1, 2012 before an acquisition transaction takes place.  The fair value of Carnes' Land and Buildings are $650,000 and $550,000, respectively. On May 1, 2012, Riley Company issues 30,000 shares of its $10 par value ($25 fair value) common stock in exchange for all of the shares of Carnes' common stock. Riley paid $10,000 for costs to issue the new shares of stock. Before the acquisition, Riley has $700,000 in its common stock account and $300,000 in its additional paid-in capital account.

The fair value of Carnes' Land and Buildings are $650,000 and $550,000, respectively. On May 1, 2012, Riley Company issues 30,000 shares of its $10 par value ($25 fair value) common stock in exchange for all of the shares of Carnes' common stock. Riley paid $10,000 for costs to issue the new shares of stock. Before the acquisition, Riley has $700,000 in its common stock account and $300,000 in its additional paid-in capital account.

On May 1, 2012, what value is assigned to Riley's investment account?

A) $150,000.

B) $300,000.

C) $750,000.

D) $760,000.

E) $1,350,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q37: What term is used to refer to

Q79: Goodwill is often acquired as part of

Q93: On January 1, 2013, the Moody Company

Q94: Direct combination costs and stock issuance costs

Q95: The financial balances for the Atwood Company

Q97: Bullen Inc. acquired 100% of the voting

Q100: Carnes has the following account balances as

Q101: On January 1, 2013, the Moody Company

Q102: Lisa Co. paid cash for all of

Q103: On January 1, 2013, the Moody Company