Multiple Choice

The following information pertains to questions

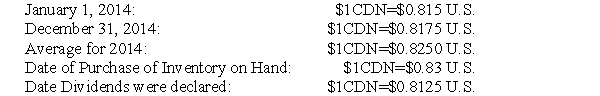

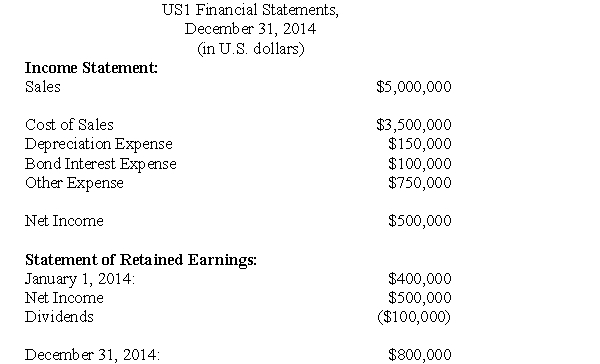

ABC Inc has a single wholly-owned American subsidiary called US1 based in Los Angeles,California which was acquired January 1,2014.US1 submitted its financial statements for 2014 to ABC.Selected exchange rates in effect throughout 2014 are shown below:  US1 Financial Results for 2014 were as follows:

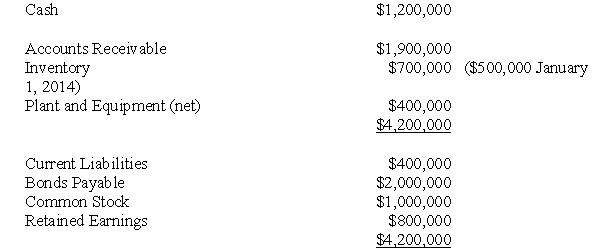

US1 Financial Results for 2014 were as follows:  Balance Sheet

Balance Sheet  For questions 17 through 22,inclusively,assume that US1 is considered to be a self-sustaining subsidiary.

For questions 17 through 22,inclusively,assume that US1 is considered to be a self-sustaining subsidiary.

-Which of the following rates would be used to translate the company's dividends?

A) $1CDN=$0.815 U.S.

B) $1CDN=$0.8125 U.S.

C) $1CDN=$0.8250 U.S.

D) $1CDN=$0.83 U.S.

Correct Answer:

Verified

Correct Answer:

Verified

Q13: The following information pertains to questions <br>On

Q14: The following information pertains to questions <br>ABC

Q15: Under the Current Rate Method:<br>A)Transaction exposure is

Q16: The risk exposure that occurs between the

Q17: The following information pertains to questions <br>ABC

Q20: The following information pertains to questions <br>On

Q22: The following information pertains to questions <br>ABC

Q49: The following information pertains to questions <br>On

Q52: Which of the following statements is correct?<br>A)

Q56: The following information pertains to questions <br>On