Essay

The following information pertains to questions

On January 1,2011,Larmer Corp.(a Canadian company)purchased 80% of Martin Inc,an American company,for $50,000 U.S.

Martin's book values approximated its fair values on that date except for plant and equipment,which had a fair market value of $30,000 U.S.with a remaining life expectancy of 5 years.A goodwill impairment loss of $1,000 U.S.occurred during 2011.

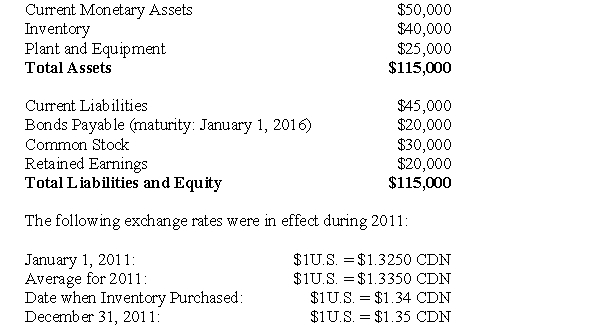

Martin's January 1,2011 Balance Sheet is shown below (in U.S.dollars):  Dividends declared and paid December 31,2011

Dividends declared and paid December 31,2011

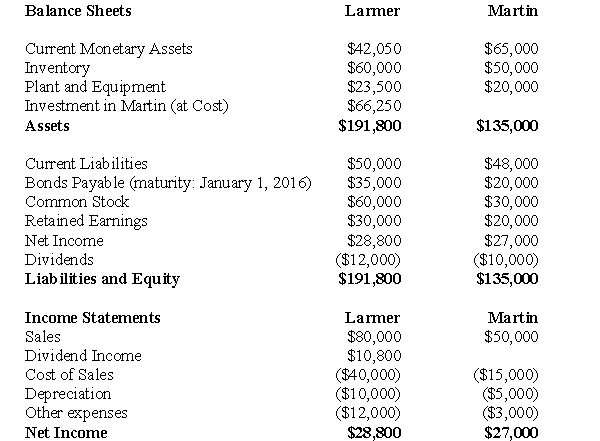

The financial statements of Larmer (in Canadian dollars)and Martin (in U.S.dollars)are shown below:  For questions 50 through 53 inclusively,assume that Martin is an integrated foreign subsidiary.

For questions 50 through 53 inclusively,assume that Martin is an integrated foreign subsidiary.

-Calculate Larmer's Consolidated Net Income for 2011.

Correct Answer:

Verified

Calculation of Conso...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q8: Which of the following statements is correct?<br>A)If

Q9: The following information pertains to questions <br>ABC

Q10: The following information pertains to questions <br>ABC

Q11: The following information pertains to questions <br>On

Q14: The following information pertains to questions <br>ABC

Q15: Under the Current Rate Method:<br>A)Transaction exposure is

Q16: The risk exposure that occurs between the

Q17: The following information pertains to questions <br>ABC

Q18: The following information pertains to questions <br>ABC

Q46: Which of the following statements is FALSE?<br>A)