Multiple Choice

The following information pertains to questions

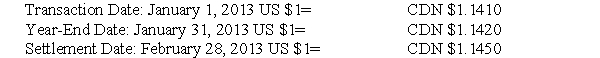

On January 1,2013,Canadian Music International (CMI) ,a manufacturer of high-end recording equipment based in Toronto,shipped $120,000 worth of inventory to its main U.S.distributor in Chicago,with full payment of these goods to be paid by February 28,2013.CMI has a January 31 year end.A list of significant dates and exchange rates is shown below.  The invoice price billed by CMI was $120,000 U.S.

The invoice price billed by CMI was $120,000 U.S.

-What is the TOTAL amount of CMI's foreign exchange gain or loss on this transaction?

A) $360 Loss.

B) $120 Gain.

C) $360 Gain.

D) $480 Gain.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: The following information pertains to questions <br>ABC

Q7: The following information pertains to questions <br>XYZ

Q8: The following information pertains to questions <br>Canada

Q9: The following information pertains to questions<br>RXN's year-end

Q10: The following information pertains to questions <br>On

Q12: The following information pertains to questions <br>XYZ

Q13: The following information pertains to questions<br>On July

Q14: The following information pertains to questions <br>XYZ

Q15: The following information refers to questions <br>On

Q16: Prepare the journal entries to record the