Multiple Choice

The following information pertains to questions

XYZ Corp has a calendar year end.On January 1,2010,the company borrowed $5,000,000 U.S.dollars from an American Bank.The loan is to be repaid on December 31,2013 and requires interest at 5% to be paid every December 31.The loan and applicable interest are both to be repaid in U.S.dollars.XYZ does not hedge to minimize its foreign exchange risk.

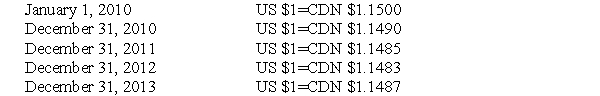

The following exchange rates were in effect throughout the term of the loan:  The average rates in effect for 2010 and 2011 were as follows:

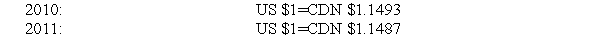

The average rates in effect for 2010 and 2011 were as follows:

-What is the amount of interest paid (in Canadian Dollars) during 2011?

A) $250,000

B) $372,500

C) $287,330

D) $287,125

Correct Answer:

Verified

Correct Answer:

Verified

Q9: The following information pertains to questions<br>RXN's year-end

Q10: The following information pertains to questions <br>On

Q11: The following information pertains to questions <br>On

Q12: The following information pertains to questions <br>XYZ

Q13: The following information pertains to questions<br>On July

Q15: The following information refers to questions <br>On

Q16: Prepare the journal entries to record the

Q17: The following information pertains to questions<br>RXN's year-end

Q18: The following information pertains to questions<br>On July

Q19: The following information pertains to questions <br>On