Multiple Choice

The following information pertains to questions

XYZ Corp has a calendar year end.On January 1,2010,the company borrowed $5,000,000 U.S.dollars from an American Bank.The loan is to be repaid on December 31,2013 and requires interest at 5% to be paid every December 31.The loan and applicable interest are both to be repaid in U.S.dollars.XYZ does not hedge to minimize its foreign exchange risk.

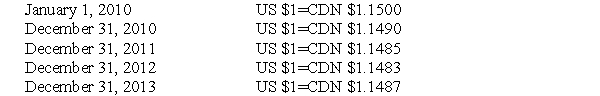

The following exchange rates were in effect throughout the term of the loan:  The average rates in effect for 2010 and 2011 were as follows:

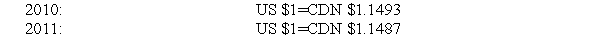

The average rates in effect for 2010 and 2011 were as follows:

-What is the amount of the foreign exchange gain or loss recognized on the 2010 Income Statement?

A) A $5,000 gain.

B) A $5,000 loss.

C) A $10,000 gain.

D) A $10,000 loss.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Some gains and losses arising on a

Q2: The following information pertains to questions<br>RXN's year-end

Q3: The following information pertains to questions<br>On July

Q5: At the balance sheet date,monetary items denominated

Q6: The following information pertains to questions <br>ABC

Q7: The following information pertains to questions <br>XYZ

Q8: The following information pertains to questions <br>Canada

Q9: The following information pertains to questions<br>RXN's year-end

Q10: The following information pertains to questions <br>On

Q11: The following information pertains to questions <br>On