Multiple Choice

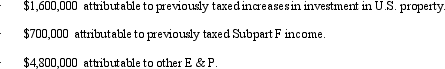

Benchmark,Inc. ,a U.S.shareholder owns 100% of a CFC from which Benchmark receives a $3 million cash distribution.The CFC's E & P is composed of the following amounts.

Benchmark recognizes a taxable dividend of:

A) $3 million.

B) $700,000.

C) $2,300,000.

D) $0.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Which of the following income items does

Q36: Which of the following would not prevent

Q46: A U.S.corporation owns a German corporation.The U.S.corporation

Q59: Arendt, Inc., a domestic corporation, purchases a

Q92: Which of the following is a special

Q109: Miles,Ltd. ,a foreign corporation,has a U.S.branch that

Q110: Monika, a nonresident alien, is employed by

Q111: Income from international communications activities earned by

Q121: ForCo, a foreign corporation, receives interest income

Q145: Miles is a citizen of France and