Multiple Choice

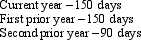

Miles is a citizen of France and does not have permanent resident status in the United States.During the last three years he has spent a number of days in the United States.

Is Miles treated as a U.S.resident for the current year?

A) No,because Miles was not present at least 183 days during the current year.

B) No,because Miles is a citizen of France.

C) Yes,because Miles was present in the United States at least 31 days during the current year and 215 days during the current and prior two years (using the appropriate fractions for the prior years) .

D) No,because although Miles was present in the United States at least 31 days during the current year,he was not present at least 183 days in a single year during the current or prior two years.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Which of the following income items does

Q41: All of an NRA's U.S.-source income that

Q46: A U.S.corporation owns a German corporation.The U.S.corporation

Q50: Rufus,Inc. ,a domestic corporation,has worldwide taxable income

Q59: Arendt, Inc., a domestic corporation, purchases a

Q109: Miles,Ltd. ,a foreign corporation,has a U.S.branch that

Q110: Monika, a nonresident alien, is employed by

Q111: Income from international communications activities earned by

Q121: ForCo, a foreign corporation, receives interest income

Q147: Benchmark,Inc. ,a U.S.shareholder owns 100% of a