Essay

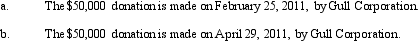

On December 30,2010,the board of directors of Gull Corporation,a calendar year,accrual method C corporation,authorized a contribution of $50,000 to a qualified charitable organization.For purposes of the taxable income limitation applicable to charitable deductions,Gull has taxable income of $420,000 and $370,000 for 2010 and 2011,respectively.Describe the tax consequences to Gull Corporation under the following independent situations.

Correct Answer:

Verified

In general,charitable contributions are ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q30: Bjorn owns a 35% interest in an

Q30: Warbler Corporation,an accrual method regular corporation,was formed

Q31: Emerald Corporation,a calendar year C corporation,was formed

Q43: In 2010,Bluebird Corporation had net income from

Q50: Bass Corporation received a dividend of $100,000

Q88: Macayo,Inc. ,received $800,000 life insurance proceeds on

Q90: C corporations can elect fiscal years that

Q92: The corporate marginal tax rates range from

Q92: Peach Corporation had $210,000 of active income,$45,000

Q95: The dividends received deduction may be subject