Multiple Choice

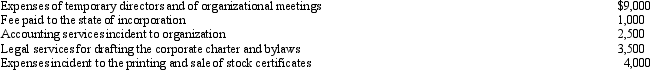

Emerald Corporation,a calendar year C corporation,was formed and began operations on July 1,2010.The following expenses were incurred during the first tax year (July 1 through December 31,2010) of operations:

Assuming a § 248 election,what is the Emerald's deduction for organizational expenditures for 2010?

A) $0.

B) $533.

C) $5,367.

D) $5,500.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q27: During the current year,Flamingo Corporation,a regular corporation

Q28: Ostrich,a C corporation,has a net short-term capital

Q30: Warbler Corporation,an accrual method regular corporation,was formed

Q30: Bjorn owns a 35% interest in an

Q35: On December 30,2010,the board of directors of

Q50: Bass Corporation received a dividend of $100,000

Q60: Hippo,Inc. ,a calendar year C corporation,manufactures golf

Q65: Generally, corporations with no taxable income must

Q92: The corporate marginal tax rates range from

Q95: The dividends received deduction may be subject