Multiple Choice

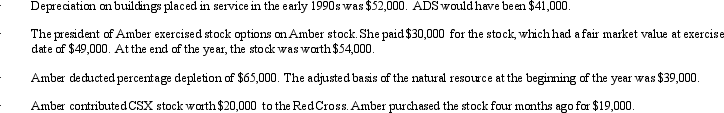

Amber,Inc. ,has taxable income of $212,000.In addition,Amber accumulates the following information which may affect its AMT.

What is Amber's AMTI?

A) $212,000.

B) $233,000.

C) $238,000.

D) $249,000.

E) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q3: A limited partnership can indirectly avoid unlimited

Q14: Swallow,Inc. ,is going to make a distribution

Q16: Paying reasonable compensation to a shareholder-employee avoids

Q17: Which of the following is descriptive of

Q18: Amos contributes land with an adjusted basis

Q21: Sam and Vera are going to establish

Q23: Parrot,Inc. ,a C corporation,distributes $300,000 to its

Q56: It is easier to satisfy the §

Q58: Samantha's basis for her partnership interest is

Q81: Which of the following statements is correct?<br>A)