Essay

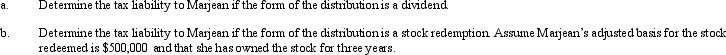

Swallow,Inc. ,is going to make a distribution of $900,000 to Marjean who is in the 35% tax bracket.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q9: A C corporation that is classified as

Q11: Blue,Inc. ,has taxable income before salary payments

Q16: Depending on the election made under the

Q16: Paying reasonable compensation to a shareholder-employee avoids

Q17: Which of the following is descriptive of

Q18: Amos contributes land with an adjusted basis

Q19: Amber,Inc. ,has taxable income of $212,000.In addition,Amber

Q24: Techniques that can be used to minimize

Q81: Which of the following statements is correct?<br>A)

Q104: Tonya contributes $150,000 to Swan,Inc.,for 75% of