Multiple Choice

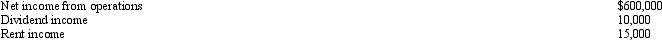

Tuna,Inc. ,a closely held corporation which is not a PSC,owns a 40% interest in Trout Partnership,which is classified as a passive activity.Trout's taxable loss for the current year is $200,000.During the year,Tuna receives a $60,000 cash distribution from Trout.Other relevant data for Tuna are as follows:

How much of Tuna's share of Trout's loss may it deduct in calculating its taxable income?

A) $0.

B) $25,000.

C) $60,000.

D) $80,000.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Walter wants to sell his wholly owned

Q33: Actual dividends paid to shareholders result in

Q69: A limited liability company LLC) is a

Q92: Rocky and Sandra (shareholders) each loan Eagle

Q113: Included among the factors that influence the

Q114: Lee owns all the stock of Vireo,Inc.

Q115: Ashley contributes property to the TCA Partnership

Q120: Which of the following statements is correct?<br>A)A

Q121: Wally contributes land (adjusted basis of $30,000;fair

Q129: Steve and Karen are going to establish