Essay

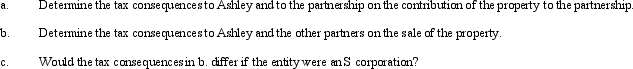

Ashley contributes property to the TCA Partnership which was formed 7 years ago by Clark and Tara.Ashley's basis for the property is $70,000 and the fair market value is $150,000.Ashley receives a 25% interest for his contribution.Because the TCA Partnership is unsuccessful in having the property rezoned from agricultural to commercial,it sells the property 12 months later for $210,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Walter wants to sell his wholly owned

Q33: Actual dividends paid to shareholders result in

Q85: If an individual contributes an appreciated personal

Q111: Of the five types of entities,only the

Q113: Included among the factors that influence the

Q114: Lee owns all the stock of Vireo,Inc.

Q118: Tuna,Inc. ,a closely held corporation which is

Q120: Which of the following statements is correct?<br>A)A

Q129: Steve and Karen are going to establish

Q131: Some fringe benefits always provide a deduction