Multiple Choice

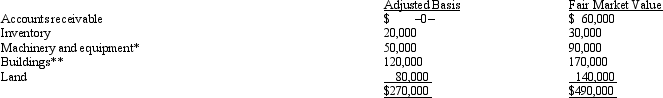

Mr.and Ms.Smith's partnership owns the following assets:

* Potential § 1245 recapture of $45,000.

** Straight-line depreciation was used.

Mr) and Ms.Smith each have a basis for their partnership interest of $135,000.Calculate their combined recognized gain or loss and classify it as capital or ordinary if they sell their partnership interests for $500,000.

A) $230,000 ordinary income.

B) $230,000 capital gain.

C) $115,000 ordinary income and $115,000 capital gain.

D) $110,000 ordinary income and $120,000 capital gain.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Albert's sole proprietorship owns the following assets:<br><img

Q8: Lime,Inc. ,has taxable income of $330,000.If Lime

Q9: A C corporation that is classified as

Q11: An S corporation is not subject to

Q11: Blue,Inc. ,has taxable income before salary payments

Q16: Depending on the election made under the

Q29: C corporations and their shareholders are subject

Q76: Why does stock redemption treatment for an

Q134: Trolette contributes property with an adjusted basis

Q165: Robin Company has $100,000 of income before