Multiple Choice

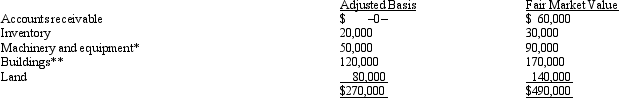

Kristine owns all of the stock of a C corporation which owns the following assets:

* Potential § 1245 recapture of $45,000.

** Straight-line depreciation was used.

Her adjusted basis for her stock is $270,000.Calculate Kristine's recognized gain or loss and classify it as capital or ordinary if she sells her stock for $500,000.

A) $230,000 ordinary income.

B) $230,000 capital gain.

C) $115,000 ordinary income and $115,000 capital gain.

D) $110,000 ordinary income and $120,000 capital gain.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q17: Which of the following statements is correct?<br>A)

Q67: The accumulated earnings tax rate in 2010

Q72: Kirby,the sole shareholder of Falcon,Inc. ,leases a

Q73: Which of the following entities has limited

Q89: From the perspective of the buyer of

Q107: C corporations and S corporations can generate

Q111: Which of the following is correct regarding

Q113: Do the § 465 at-risk rules apply

Q116: Aaron purchases a building for $500,000 which

Q129: An effective way for all C corporations