Essay

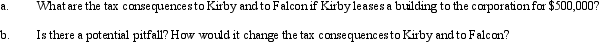

Kirby,the sole shareholder of Falcon,Inc. ,leases a building to the corporation.The taxable income of the corporation for 2010,before deducting the lease payments,is projected to be $500,000.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q50: The corporate tax rate for a business

Q67: The accumulated earnings tax rate in 2010

Q68: Kristine owns all of the stock of

Q71: Candace, who is in the 33% tax

Q73: Which of the following entities has limited

Q89: From the perspective of the buyer of

Q107: C corporations and S corporations can generate

Q111: Which of the following is correct regarding

Q121: A major benefit of the S corporation

Q123: Personal service corporations can offset passive activity