Multiple Choice

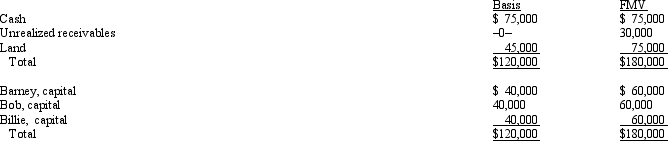

Barney,Bob,and Billie are equal partners in the BBB Partnership.The partnership balance sheet reads as follows on December 31 of the current year:

Partner Billie has an adjusted basis of $40,000 for her partnership interest.If Billie sells her entire partnership interest to new partner Janet for $60,000 cash,how much capital gain and ordinary income must Billie recognize from the sale?

A) $20,000 ordinary income.

B) $20,000 capital gain.

C) $10,000 ordinary income;$10,000 capital gain.

D) $30,000 ordinary income;$10,000 capital loss.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q24: Larry's partnership interest basis is $60,000.Larry receives

Q42: Which of the following statements correctly reflects

Q46: In a proportionate liquidating distribution, Lina receives

Q47: A § 754 election is made for

Q48: In a liquidating distribution, a partnership must

Q72: Paul is a 25% owner in the

Q76: The December 31,2010,balance sheet of the BCD

Q78: The December 31,2010,balance sheet of the DIP

Q92: Normally a distribution of property from a

Q115: Maggie,a partner in the Magpie partnership,received a