Essay

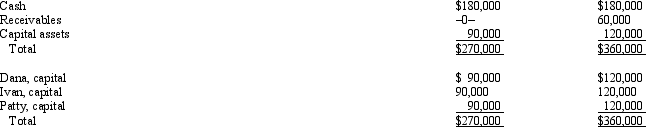

The December 31,2010,balance sheet of the DIP General Partnership is as follows:

The partners share equally in partnership capital,income,gain,loss,deduction,and credit and capital is not a material income-producing factor.On December 31,2010,general partner Dana receives a distribution of $120,000 cash in liquidation of her interest under § 736.Dana's outside basis for the partnership interest immediately before the distribution is $90,000.What is Dana's gain or loss on the distribution and its character?

Correct Answer:

Verified

The $20,000 payment for Dana's share of ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q23: In a proportionate liquidating distribution,RST Partnership distributes

Q24: Larry's partnership interest basis is $60,000.Larry receives

Q28: In a proportionate liquidating distribution, UVW Partnership

Q63: The ABC Partnership makes a proportionate distribution

Q73: Barney,Bob,and Billie are equal partners in the

Q76: The December 31,2010,balance sheet of the BCD

Q81: Landon received $30,000 cash and a capital

Q92: Normally a distribution of property from a

Q92: For income tax purposes, proportionate and disproportionate

Q115: Maggie,a partner in the Magpie partnership,received a