Essay

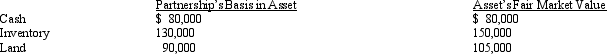

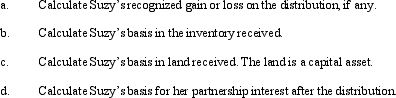

Suzy owns a 25% capital and profits interest in the calendar-year SJDV Partnership.Her adjusted basis for her partnership interest on July 1 of the current year is $200,000.On that date,she receives a proportionate nonliquidating current distribution of the following assets:

Correct Answer:

Verified

Correct Answer:

Verified

Q7: A partnership may make an optional election

Q22: A payment to a retiring partner for

Q33: The December 31,2010,balance sheet of the calendar-year

Q43: Which of the following statements about the

Q55: Last year,Oscar contributed nondepreciable property with a

Q61: Which of the following distributions would never

Q77: Carl receives a proportionate nonliquidating distribution when

Q85: At the beginning of the year, Elsie's

Q120: A disproportionate distribution arises when the partnership

Q146: Jackie owns a 40% interest in the