Essay

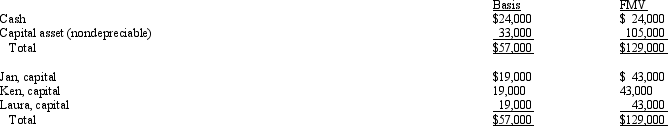

The December 31,2010,balance sheet of the calendar-year JKL Partnership reads as follows.

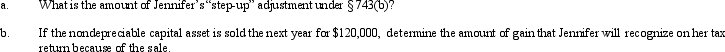

Each partner shares in 1/3 of the partnership capital,income,gain,loss,deduction and credit.On December 31,2010,Jan sells her 1/3 partnership interest to Jennifer for $43,000 cash.Assume the partnership makes a § 754 election for 2010.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: A partnership may make an optional election

Q22: A payment to a retiring partner for

Q32: Suzy owns a 25% capital and profits

Q43: Which of the following statements about the

Q55: Last year,Oscar contributed nondepreciable property with a

Q61: Which of the following distributions would never

Q77: Carl receives a proportionate nonliquidating distribution when

Q85: At the beginning of the year, Elsie's

Q123: Nick sells his 25% interest in the

Q146: Jackie owns a 40% interest in the