Essay

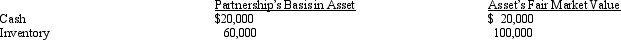

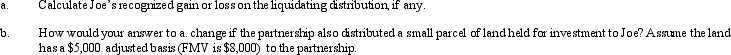

Joe has a 25% capital and profits interest in the calendar-year GDJ Partnership.His adjusted basis for his partnership interest on October 15 of the current year is $200,000.On that date,the partnership liquidates and makes a proportionate distribution of the following assets to Joe.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Jason sold his 40% interest in the

Q39: Last year, Darby contributed land (basis of

Q82: In a proportionate liquidating distribution, Scott receives

Q84: A partnership continues in existence unless one

Q86: The Crimson Partnership is a service provider.

Q88: Partner Jordan received a distribution of $80,000

Q92: Milton contributed property to the MDB Partnership

Q96: The JIH Partnership distributed the following assets

Q122: William's basis in the WAM Partnership interest

Q156: Francine receives a proportionate liquidating distribution when