Multiple Choice

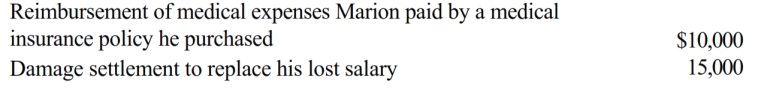

Early in the year, Marion was in an automobile accident during the course of his employment. As a result of the physical injuries he sustained, he received the following payments during the year:

What is the amount that Marion must include in gross income for the current year?

A) $25,000.

B) $15,000.

C) $12,500.

D) $10,000.

E) $0.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: The taxpayer's marginal federal and state tax

Q46: The de minimis fringe benefit:<br>A)Exclusion applies only

Q58: If a scholarship does not satisfy the

Q61: Fresh Bakery often has unsold donuts at

Q85: Sharon had some insider information about a

Q86: During the current year, Khalid was in

Q88: Agnes receives a $5,000 scholarship which covers

Q90: Sally and Ed each own property with

Q91: Meg's employer carries insurance on its employees

Q93: Nicole's employer pays her $150 per month