Multiple Choice

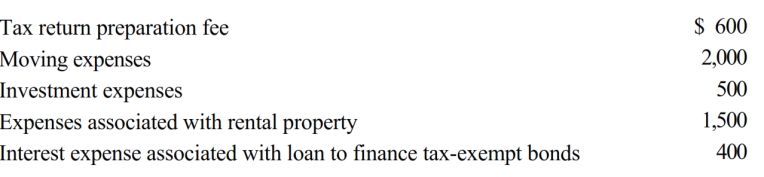

Cory incurred and paid the following expenses in 2018:

Calculate the amount that Cory can deduct (before any percentage limitations) .

A) $5,000.

B) $4,600.

C) $3,000.

D) $1,500.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q33: A hobby activity results in all of

Q39: Robin and Jeff own an unincorporated hardware

Q44: Jacques, who is not a U.S.citizen, makes

Q143: Bruce owns several sole proprietorships. Must Bruce

Q144: A vacation home at the beach which

Q146: The stock of Eagle, Inc. is owned

Q149: Which of the following is a required

Q150: Velma and Bud divorced. Velma's attorney fee

Q151: Which of the following is incorrect?<br>A) Alimony

Q153: Tommy, an automobile mechanic employed by an