Essay

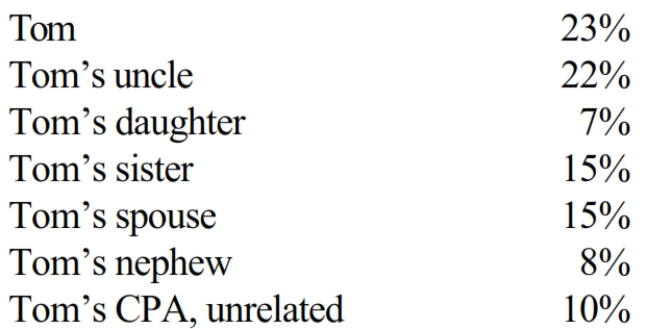

The stock of Eagle, Inc. is owned as follows:

Tom sells land and a building to Eagle, Inc. for $212,000. His adjusted basis for these assets is $225,000. Calculate

Tom's realized and recognized loss associated with the sale.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q33: A hobby activity results in all of

Q44: Jacques, who is not a U.S.citizen, makes

Q93: In a related-party transaction where realized loss

Q141: Sandra owns an insurance agency. The following

Q143: Bruce owns several sole proprietorships. Must Bruce

Q144: A vacation home at the beach which

Q148: Cory incurred and paid the following expenses

Q149: Which of the following is a required

Q150: Velma and Bud divorced. Velma's attorney fee

Q151: Which of the following is incorrect?<br>A) Alimony