Multiple Choice

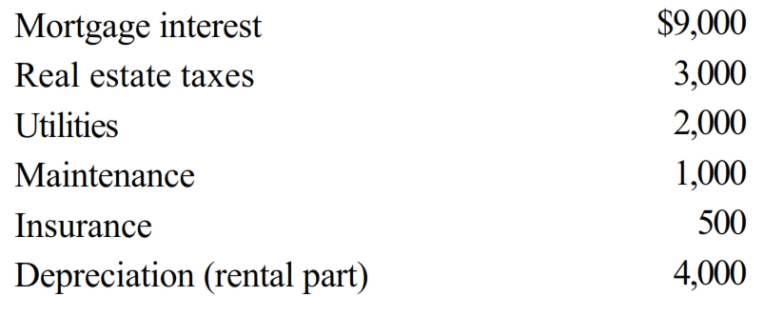

Robyn rents her beach house for 60 days and uses it for personal use for 30 days during the year. The rental income is $6,000 and the expenses are as follows:

Using the IRS approach, total expenses that Robyn can deduct on her tax return associated with the beach house are:

A) $0.

B) $6,000.

C) $8,000.

D) $12,000.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Ordinary and necessary business expenses, other than

Q17: If property taxes and home mortgage interest

Q20: For an activity classified as a hobby,

Q22: Investigation of a business unrelated to one's

Q80: For purposes of the § 267 loss

Q86: Terry and Jim are both involved in

Q87: Under what circumstances may a taxpayer deduct

Q88: During 2017, the first year of operations,

Q94: Austin, a single individual with a salary

Q95: In determining whether an activity should be