Essay

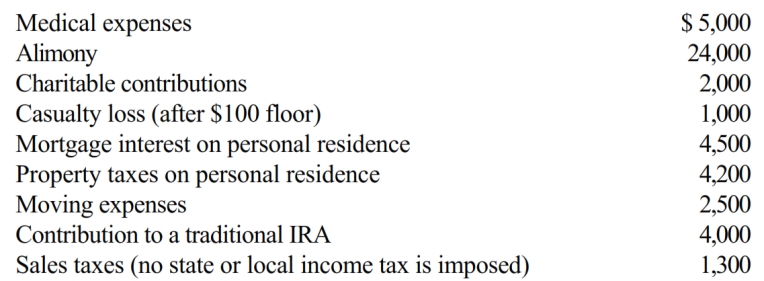

Austin, a single individual with a salary of $100,000, incurred and paid the following expenses during 2018:

Calculate Austin's deductions for AGI.

Correct Answer:

Verified

Only the following expenses ar...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Only the following expenses ar...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q6: Ordinary and necessary business expenses, other than

Q17: If property taxes and home mortgage interest

Q20: For an activity classified as a hobby,

Q22: Investigation of a business unrelated to one's

Q80: For purposes of the § 267 loss

Q91: Robyn rents her beach house for 60

Q95: In determining whether an activity should be

Q97: If a residence is used primarily for

Q98: For a president of a publicly held

Q144: In applying the $1 million limit on