Essay

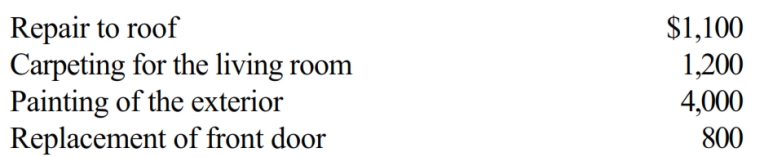

Marvin spends the following amounts on a house he owns:

a. How much of these expenses can Marvin deduct if the house is his principal residence?

b. How much of these expenses can Marvin deduct if he rents the house to a tenant?

c. Classify any deductible expenses as deductions for AGI or as deductions from AGI.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Bob and April own a house at

Q3: Sammy, a calendar year cash basis taxpayer

Q4: Sandra sold 500 shares of Wren Corporation

Q7: Under the "twelve month rule" for the

Q8: Depending on the nature of the expenditure,

Q10: Walt wants to give his daughter $1,800

Q22: Describe the circumstances under which a taxpayer

Q77: Beulah's personal residence has an adjusted basis

Q88: LD Partnership, a cash basis taxpayer, purchases

Q121: Why are there restrictions on the recognition