Multiple Choice

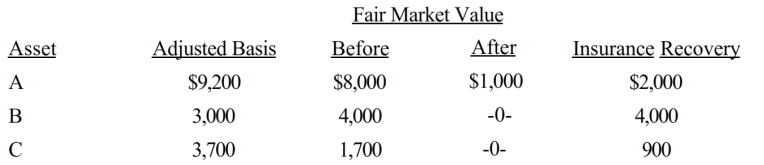

In 2018, Wally had the following insured personal casualty losses (arising from one casualty in a Federally-declared disaster area) . Wally also had $42,000 AGI for the year before considering the casualty.

A) $1,500.

B) $1,600.

C) $4,800.

D) $58,000.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q4: Taxpayer's home was destroyed by a storm

Q17: A business theft loss is taken in

Q25: Neal, single and age 37, has the

Q27: Gary, who is an employee of Red

Q28: A corporation which makes a loan to

Q29: Regarding research and experimental expenditures, which of

Q31: On February 20, 2017, Bill purchased stock

Q37: The amount of loss for partial destruction

Q98: If personal casualty gains exceed personal casualty

Q112: A bona fide debt cannot arise on