Essay

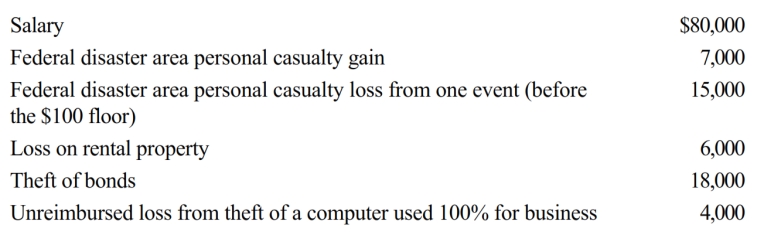

Gary, who is an employee of Red Corporation, has the following items for 2018:

Determine Gary's AGI and total amount of itemized deductions for 2018.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q17: A business theft loss is taken in

Q25: Neal, single and age 37, has the

Q26: In 2018, Wally had the following insured

Q28: A corporation which makes a loan to

Q29: Regarding research and experimental expenditures, which of

Q31: On February 20, 2017, Bill purchased stock

Q32: Roger, an individual, owns a proprietorship called

Q37: The amount of loss for partial destruction

Q98: If personal casualty gains exceed personal casualty

Q112: A bona fide debt cannot arise on