Multiple Choice

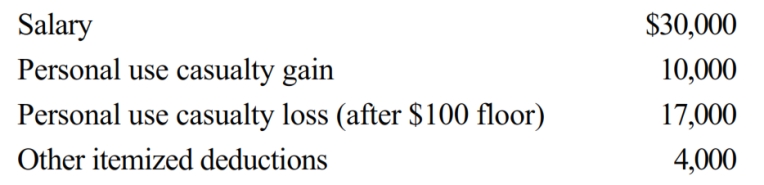

In 2018, Mary had the following items:

Assuming that Mary files as head of household (has one dependent child) , determine her taxable income for 2018.

A) $12,000

B) $12,800

C) $13,900

D) $21,900

E) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q2: Discuss the tax treatment of nonreimbursed losses

Q12: A loss is not allowed for a

Q38: John files a return as a single

Q42: In 2017, Sarah (who files as single)

Q42: If an election is made to defer

Q43: Maria, who is single, had the following

Q44: Three years ago, Sharon loaned her sister

Q46: In the current year, Juan's home was

Q54: If a noncorporate taxpayer has an excess

Q106: If a business debt previously deducted as