Essay

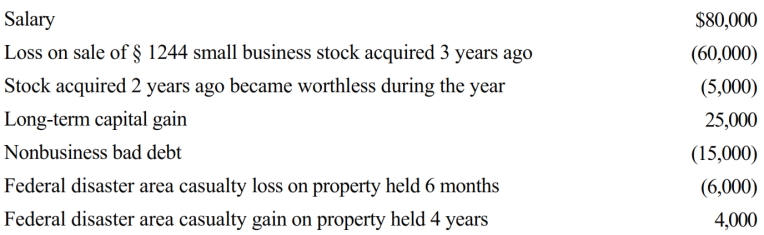

Maria, who is single, had the following items for 2018:

Determine Maria's adjusted gross income for 2018.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q2: Discuss the tax treatment of nonreimbursed losses

Q38: John files a return as a single

Q41: In 2018, Mary had the following items:

Q42: In 2017, Sarah (who files as single)

Q42: If an election is made to defer

Q44: Three years ago, Sharon loaned her sister

Q46: In the current year, Juan's home was

Q47: On July 20, 2017, Matt (who files

Q48: Last year, Green Corporation incurred the following

Q106: If a business debt previously deducted as