Essay

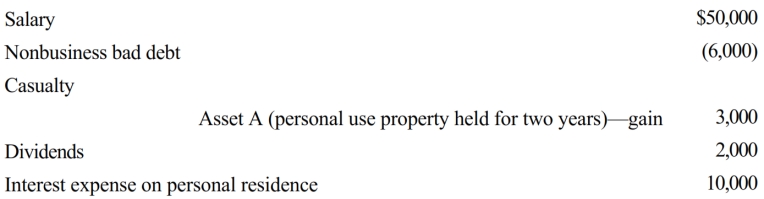

Mike, single, age 31, had the following items for 2018:

Compute Mike's taxable income for 2018.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q14: A business bad debt is a debt

Q18: A taxpayer can carry an NOL forward

Q80: The amount of partial worthlessness on a

Q84: While Susan was on vacation during the

Q85: In 2018, Morley, a single taxpayer, had

Q86: Last year, Lucy purchased a $100,000 account

Q87: Alicia was involved in an automobile accident

Q88: In 2017, Amos had AGI of $50,000.

Q91: Susan has the following items for 2018:<br>?

Q92: A taxpayer can carry back any NOL