Essay

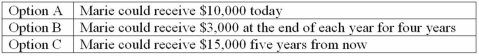

Marie is considering several possible investment alternatives.

Required:

1.Calculate the present value of each option assuming Marie can earn 8% on any of the investment funds.

2.Which option results in the greatest financial benefit to Marie?

Correct Answer:

Verified

Note to the instructor: Presen...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q8: There is a reciprocal relationship between which

Q10: On October 1,20A,Britt Company issued a $5,000,6%,bond

Q12: As a held-to-maturity investment,Jones Company purchased a

Q14: If there is a loss on bonds

Q15: When the market rate of interest is

Q16: On November 1,20A,Rossy Co.purchased $100,000,9%,ten-year bonds of

Q24: The times interest earned ratio uses accrual

Q66: Calculation of the amount of the equal

Q135: The future value of $1 is always

Q141: On the maturity date of bonds payable