Essay

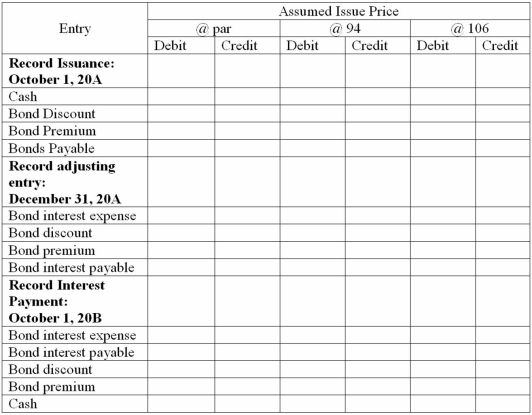

On October 1,20A,Britt Company issued a $5,000,6%,bond payable.The interest is payable annually each October 1 and the bond matures in five years.The annual accounting period for the company ends December 31.Complete the following entries at the date specified under three different assumptions as to the issue price.Use straight-line amortization.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Typical non-current liabilities include lease obligations, asset

Q6: A bond liability usually should be reclassified

Q7: Millwood Company prepared a bond issue dated

Q8: There is a reciprocal relationship between which

Q12: As a held-to-maturity investment,Jones Company purchased a

Q13: Marie is considering several possible investment alternatives.<br>Required:<br>1.Calculate

Q14: If there is a loss on bonds

Q15: When the market rate of interest is

Q24: The times interest earned ratio uses accrual

Q135: The future value of $1 is always