Essay

Millwood Company prepared a bond issue dated January 1,20A.On January 1,20A,the company sold $100,000 of its par value bonds at 103.The bonds mature in thirty years and have a stated rate of interest of 8% per year.Interest is payable annually on December 31.Straight-line amortization is used (round to the nearest dollar).

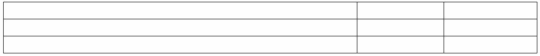

(a)Give the entry to record the sale of bonds on January 1,20A:

(b)Give the entry to record interest expense at December 31,20A (end of the annual accounting period)

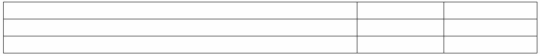

(c)Show how the bonds would be reported on the balance sheet of Millwood Company dated December 31,20C

Correct Answer:

Verified

(a)(b)(c)*...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

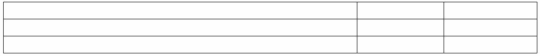

Q2: On January 1,20A,A-Ace Corp.issued $3,000,000 par value

Q3: Typical non-current liabilities include lease obligations, asset

Q3: The cash collected when a bond is

Q4: Long-term debt carries additional risk because interest

Q6: A bond liability usually should be reclassified

Q8: There is a reciprocal relationship between which

Q10: On October 1,20A,Britt Company issued a $5,000,6%,bond

Q12: As a held-to-maturity investment,Jones Company purchased a

Q24: The times interest earned ratio uses accrual

Q135: The future value of $1 is always