Multiple Choice

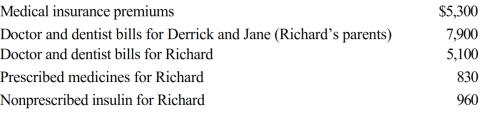

Richard, age 50, is employed as an actuary. For calendar year 2018, he had AGI of $130,000 and paid the following medical expenses:

Derrick and Jane would qualify as Richard's dependents except that they file a joint return. Richard's medical insurance policy does not cover them. Richard filed a claim for $4,800 of his own expenses with his insurance company in November 2018 and received the reimbursement in January 2019. What is Richard's maximum allowable medical expense deduction for 2018?

A) $0

B) $7,090

C) $10,340

D) $20,090

E) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Mindy paid an appraiser to determine how

Q63: During the year, Victor spent $300 on

Q85: Noah gave $750 to a good friend

Q95: In the current year, Jerry pays $8,000

Q96: This year Dena traveled 600 miles for

Q98: Paul and Patty Black (both are age

Q99: Joe, who is in the 32% tax

Q100: Sadie mailed a check for $2,200 to

Q101: In 2018, Boris pays a $3,800 premium

Q103: Hugh, a self-employed individual, paid the following