Multiple Choice

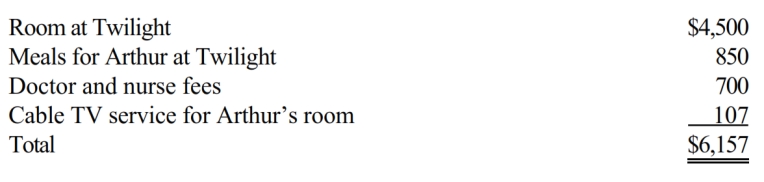

Sandra is single and does a lot of business entertaining at home. Because Arthur, Sandra's 80-year old dependent grandfather who lived with Sandra, needs medical and nursing care, he moved to Twilight Nursing Home. During the year, Sandra made the following payments on behalf of Arthur:

Twilight has medical staff in residence. Disregarding the AGI floor, how much, if any, of these expenses qualify for a medical deduction by Sandra?

A) $6,157

B) $6,050

C) $5,200

D) $1,550

E) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Manny, age 57, developed a severe heart

Q9: Zeke made the following donations to qualified

Q10: Fred and Lucy are married, ages 33

Q11: Georgia had AGI of $100,000 in 2018.

Q14: In Lawrence County, the real property tax

Q15: Brad, who uses the cash method of

Q18: Herbert is the sole proprietor of a

Q18: Brian, a self-employed individual, pays state income

Q28: Linda is planning to buy Vicki's home.They

Q64: Employee business expenses for travel may be