Multiple Choice

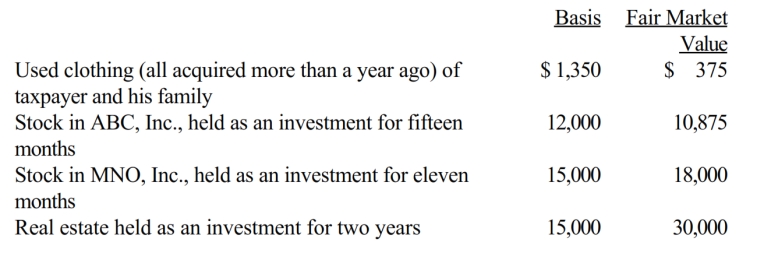

Zeke made the following donations to qualified charitable organizations during the year:

The used clothing was donated to the Salvation Army? the other items of property were donated to Eastern State University. Both are qualified charitable organizations. Disregarding percentage limitations, Zeke's charitable contribution deduction for the year is:

A) $43,350.

B) $56,250.

C) $59,250.

D) $60,375.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Linda, who has AGI of $120,000 in

Q7: Quinn, who is single and lives alone,

Q8: Manny, age 57, developed a severe heart

Q10: Fred and Lucy are married, ages 33

Q11: Georgia had AGI of $100,000 in 2018.

Q12: Dan contributed stock worth $16,000 to his

Q13: Sandra is single and does a lot

Q14: In Lawrence County, the real property tax

Q28: Linda is planning to buy Vicki's home.They

Q56: Sergio was required by the city to