Multiple Choice

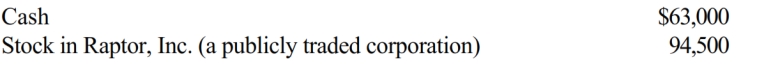

During the current year, Ralph made the following contributions to the University of Oregon (a qualified charitable organization) :

Ralph acquired the stock in Raptor, Inc., as an investment fourteen months ago at a cost of $42,000. Ralph's AGI for the year is $189,000. What is Ralph's charitable contribution deduction for the current year?

A) $56,700

B) $63,000

C) $94,500

D) $157,500

E) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Jim's employer pays half of the premiums

Q5: Grace's sole source of income is from

Q23: Helen pays nursing home expenses of $3,000

Q25: Gambling losses may be deducted to the

Q50: Interest paid or accrued during 2018 on

Q54: In 2018, Brandon, age 72, paid $5,000

Q56: Upon the recommendation of a physician, Ed

Q58: George is single and age 56, has

Q60: Linda borrowed $60,000 from her parents for

Q62: Ronaldo contributed stock worth $12,000 to the