Essay

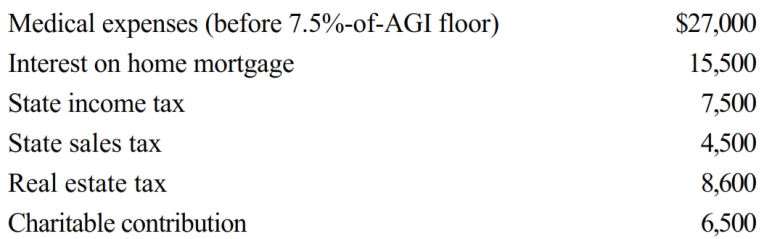

George is single and age 56, has AGI of $265,000, and incurs the following expenditures in 2018.

What is the amount of itemized deductions George may claim?

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q4: Jim's employer pays half of the premiums

Q23: Helen pays nursing home expenses of $3,000

Q25: Gambling losses may be deducted to the

Q54: In 2018, Brandon, age 72, paid $5,000

Q55: During the current year, Ralph made the

Q56: Upon the recommendation of a physician, Ed

Q60: Linda borrowed $60,000 from her parents for

Q62: Edna had an accident while competing in

Q75: A taxpayer pays points to obtain financing

Q98: Fees for automobile inspections, automobile titles and