Multiple Choice

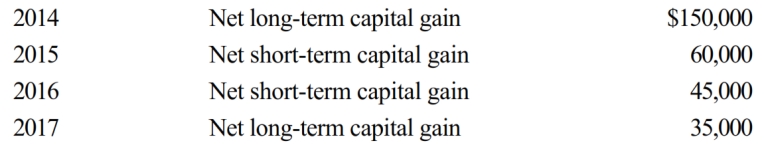

Carrot Corporation, a C corporation, has a net short-term capital gain of $65,000 and a net long-term capital loss of $250,000 during 2018. Carrot Corporation had taxable income from other sources of $720,000. Prior years' transactions included the following:  Compute the amount of Carrot's capital loss carryover to 2019.

Compute the amount of Carrot's capital loss carryover to 2019.

A) $0

B) $32,000

C) $45,000

D) $185,000

E) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q39: During the current year, Quartz Corporation (a

Q40: Copper Corporation, a C corporation, had gross

Q40: Peach Corporation had $210,000 of net active

Q42: Elk, a C corporation, has $370,000 operating

Q45: During the current year, Sparrow Corporation, a

Q50: For purposes of the accumulated earnings tax,

Q51: The limitation on the deduction of business

Q76: Briefly discuss the current-year requirements for the

Q108: Income that is included in net income

Q128: Adrian is the president and sole shareholder