Essay

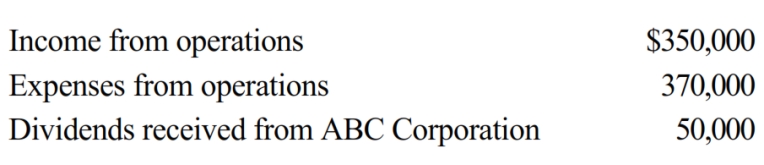

During the current year, Quartz Corporation (a calendar year C corporation) has the following transactions:

Quartz owns 25% of ABC Corporation's stock. How much is Quartz Corporation's taxable income (loss) for the year?

Correct Answer:

Verified

The dividends received deduct...

The dividends received deduct...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q34: Ivory Corporation, a calendar year, accrual method

Q36: On December 20, 2018, the directors of

Q37: Copper Corporation, a calendar year C corporation,

Q40: Copper Corporation, a C corporation, had gross

Q42: Elk, a C corporation, has $370,000 operating

Q44: Carrot Corporation, a C corporation, has a

Q77: A calendar year C corporation can receive

Q98: Katherine, the sole shareholder of Penguin Corporation,

Q108: Income that is included in net income

Q128: Adrian is the president and sole shareholder