Multiple Choice

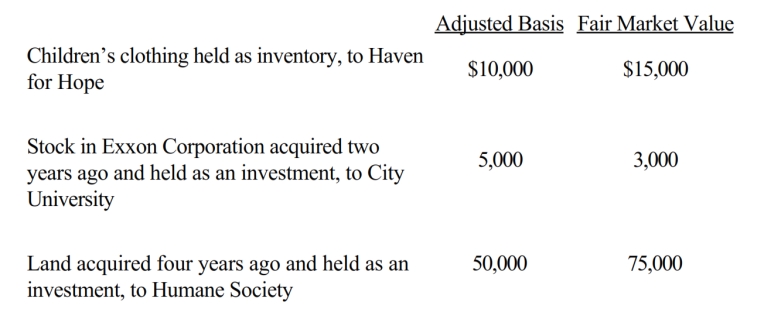

During the current year, Owl Corporation (a C corporation) , a retailer of children's apparel, made the following donations to qualified charitable organizations.  How much qualifies for the charitable contribution deduction (ignoring the taxable income limitation) ?

How much qualifies for the charitable contribution deduction (ignoring the taxable income limitation) ?

A) $63,000

B) $65,000

C) $90,500

D) $92,500

E) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q13: Employment taxes apply to all entity forms

Q40: Peach Corporation had $210,000 of net active

Q45: During the current year, Sparrow Corporation, a

Q50: For purposes of the accumulated earnings tax,

Q51: The limitation on the deduction of business

Q53: Opal Corporation, an accrual method, calendar year

Q54: Schedule M-1 of Form 1120 is used

Q55: Almond Corporation, a calendar year C corporation,

Q76: Briefly discuss the current-year requirements for the

Q116: Because of the taxable income limitation, no