Multiple Choice

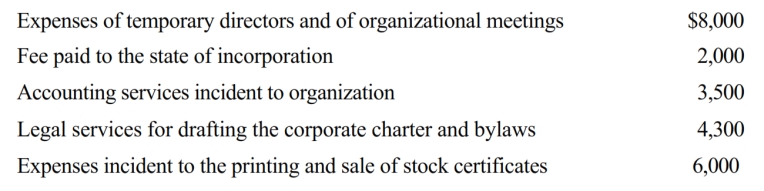

Opal Corporation, an accrual method, calendar year taxpayer, was formed and began operations on July 1, 2018. The following expenses were incurred during the first tax year (July 1 through December 31, 2018) of operations.  Assuming a § 248 election, what is Opal's deduction for organizational expenditures for 2018?

Assuming a § 248 election, what is Opal's deduction for organizational expenditures for 2018?

A) $593.

B) $460.

C) $5,427.

D) $5,627.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q10: In the current year, Tern, Inc., a

Q13: Employment taxes apply to all entity forms

Q40: Peach Corporation had $210,000 of net active

Q46: Dawn is the sole shareholder of Thrush

Q50: During the current year, Owl Corporation (a

Q54: Schedule M-1 of Form 1120 is used

Q55: Almond Corporation, a calendar year C corporation,

Q57: Patrick, an attorney, is the sole shareholder

Q76: Briefly discuss the current-year requirements for the

Q116: Because of the taxable income limitation, no