Multiple Choice

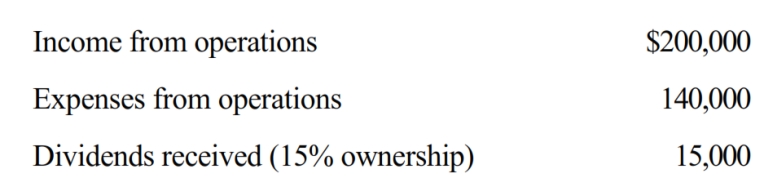

During the current year, Kingbird Corporation (a calendar year C corporation) had the following income and expenses:  On October 1, Kingbird Corporation made a contribution to a qualified charitable organization of $9,000 in cash (not included in any of the above items) . Determine Kingbird's charitable contribution deduction for the current year.

On October 1, Kingbird Corporation made a contribution to a qualified charitable organization of $9,000 in cash (not included in any of the above items) . Determine Kingbird's charitable contribution deduction for the current year.

A) $9,000

B) $7,500

C) $6,750

D) $6,525

E) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q4: On December 31, 2018, Lavender, Inc., an

Q12: Contrast the tax treatment of capital gains

Q12: Warbler Corporation, an accrual method regular corporation,

Q13: Canary Corporation, a calendar year C corporation,

Q13: Eagle Corporation, a calendar year C corporation,

Q23: The accumulated earnings and personal holding company

Q25: For purposes of the estimated tax payment

Q32: As a general rule, C corporations must

Q52: Luis is the sole shareholder of a

Q132: Canary Corporation, which sustained a $5,000 net