Essay

Warbler Corporation, an accrual method regular corporation, was formed and began operations on March 1, 2018.

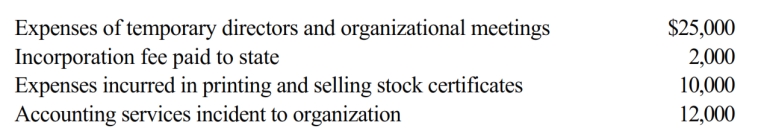

The following expenses were incurred during its first year of operations (March 1 - December 31, 2018):

a. Assuming a valid election under § 248 to amortize organizational expenditures, what is the amount of Warbler's deduction for 2018?

b. Same asa., except that Warbler also incurred in 2018 legal fees of $15,000 for the drafting of the corporate charter and bylaws. What is the amount of Warbler's 2018 deduction for organizational expenditures?

Correct Answer:

Verified

a. Warbler has qualifying organizational...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q9: During the current year, Kingbird Corporation (a

Q12: Contrast the tax treatment of capital gains

Q13: Eagle Corporation, a calendar year C corporation,

Q15: Robin Corporation, a calendar year C corporation,

Q16: In the current year, Crimson, Inc., a

Q17: On December 31, 2018, Flamingo, Inc., a

Q23: The accumulated earnings and personal holding company

Q25: For purposes of the estimated tax payment

Q32: As a general rule, C corporations must

Q132: Canary Corporation, which sustained a $5,000 net