Essay

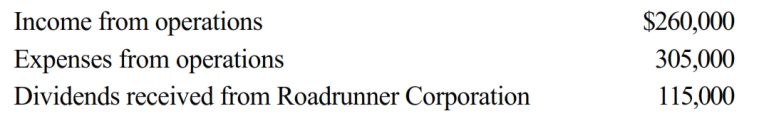

During the current year, Coyote Corporation (a calendar year C corporation) has the following transactions:

a. Coyote owns 5% of Roadrunner Corporation's stock. How much is Coyote Corporation's taxable income (loss) for the year?

b. Would your answer change if Coyote owned 25% of Roadrunner Corporation's stock?

Correct Answer:

Verified

a. The key to this question is the relat...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q64: Azure Corporation, a C corporation, had a

Q82: Tonya, an actuary, is the sole shareholder

Q83: In each of the following independent situations,

Q85: Saleh, an accountant, is the sole shareholder

Q87: Emerald Corporation, a calendar year C corporation,

Q88: A calendar year personal service corporation with

Q88: The $1 million limitation on the deduction

Q91: Hornbill Corporation, a cash basis and calendar

Q110: Schedule M-2 is used to reconcile unappropriated

Q115: Albatross, a C corporation, had $140,000 net