Essay

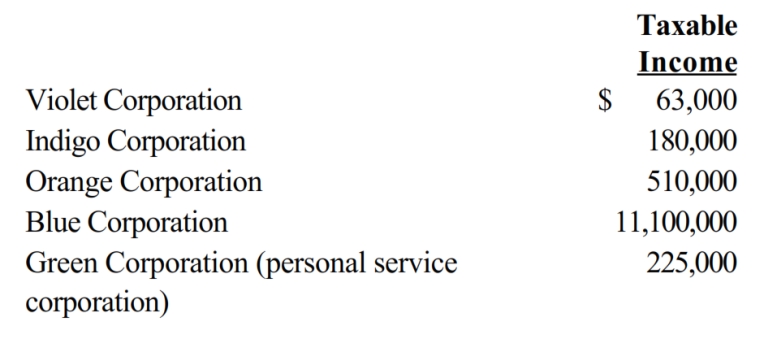

In each of the following independent situations, determine the C corporation's income tax liability. Assume that all corporations use a calendar year 2017.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q78: A corporate net operating loss arising in

Q79: Grebe Corporation, a closely held corporation that

Q80: Which of the following statements is incorrect

Q82: Tonya, an actuary, is the sole shareholder

Q85: Saleh, an accountant, is the sole shareholder

Q86: During the current year, Coyote Corporation (a

Q87: Emerald Corporation, a calendar year C corporation,

Q88: A calendar year personal service corporation with

Q88: The $1 million limitation on the deduction

Q115: Albatross, a C corporation, had $140,000 net